33+ 10 year fixed mortgage calculator

A fixed deposit calculator is a tool designed to get an estimate about the maturity amount that the investor should expect at the end of a chosen tenure for a specified deposit amount at the applicable rate of interest. Our Closing Costs study assumed a 30-year fixed-rate mortgage with a 20 down payment on each countys median home value.

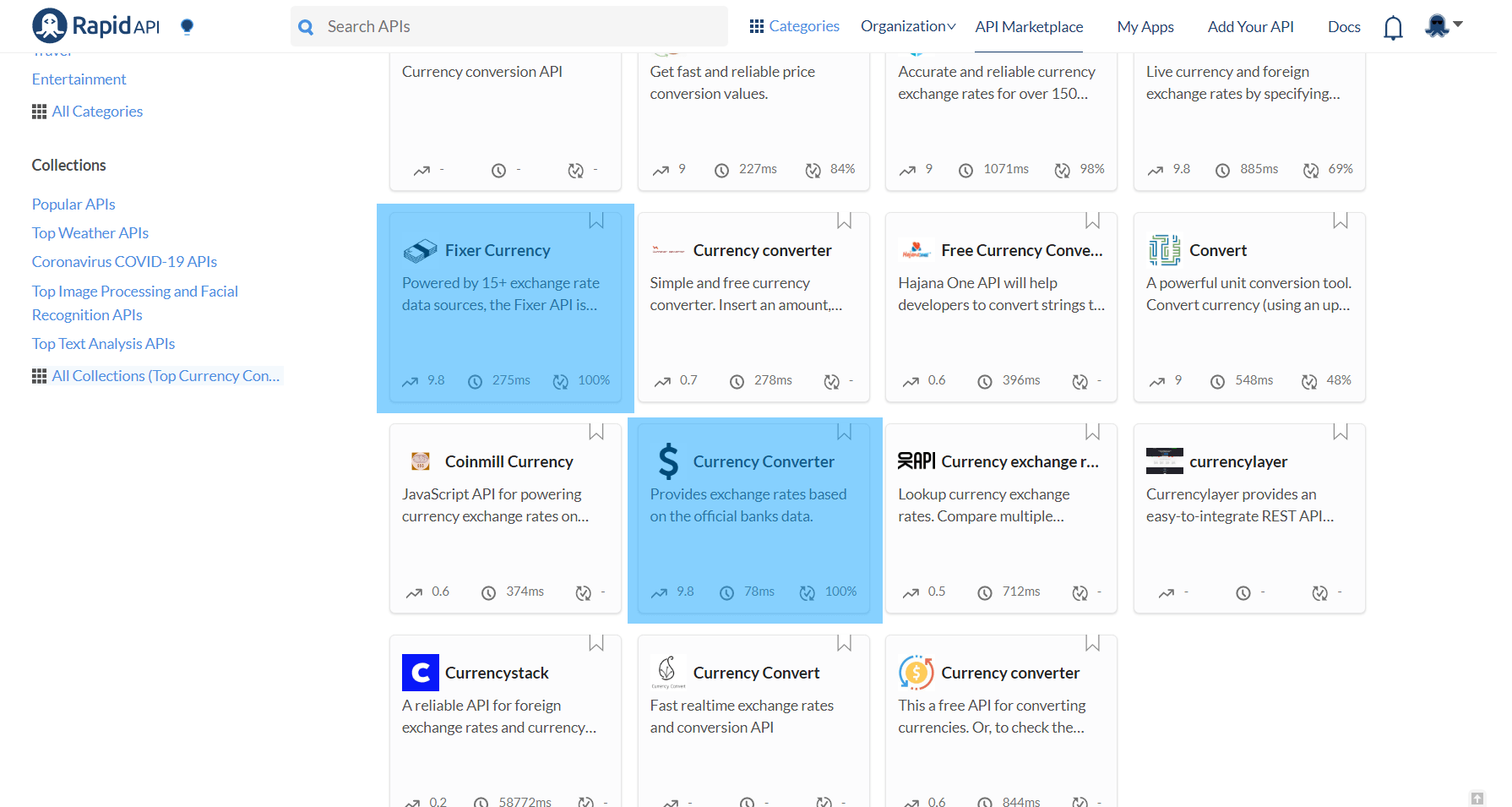

Top 9 Best Currency Converter Apis 2021 33 Reviewed

Commonly people select 3 or 10-year fixed-rate mortgages.

. If you take out five consecutive two-year deals over a 10-year period youll be paying any fees five times over potentially setting you back 8500 if you pay the 1700 fee on the current lowest-rate two-year fix up to 60 loan-to-value LTV. By default 250000 30-yr fixed-rate loans are displayed in the table below. To show you how this works lets compare two 30-year fixed mortgages with the same variables.

Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find. A major advantage of a 30-year fixed mortgage is the security in knowing exactly how much youll. Well find you.

Avoid extra mortgage fees. How much money could you save. We used the calculator on top the determine the results.

We considered all applicable closing costs including the mortgage tax transfer tax and both fixed and variable fees. N 30 years x 12 months per year or 360 payments. Well also compare payments between 10-year 15-year and 30-year fixed-rate mortgages.

Todays mortgage rates in Texas are 5870 for a 30-year fixed 4965 for a 15-year fixed and 5238 for a 5-year adjustable-rate mortgage ARM. Our simple mortgage calculator with taxes and insurance makes it easy to calculate your mortgage payment without the headache of performing the tedious math yourselfor worse guesstimating what the payments might be. Getting ready to buy a home.

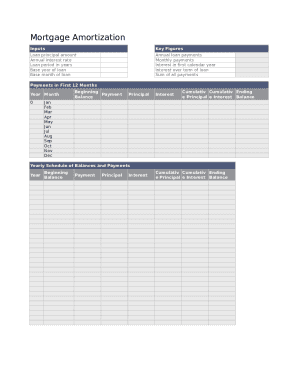

So if you originally took out a 25 year mortgage five years ago then enter 20 into here. Filters enable you to change the loan amount duration or loan type. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

Lock-in Redmonds Low 30-Year Mortgage Rates Today. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. Our mortgage overpayments calculator will show you how much interest you could save by making regular overpayments each month.

The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. Yes your mortgage payments are kept the same throughout the loan.

A fixed-rate deal for example - enter that rate here. A 15-year fixed-rate mortgage comes with a monthly payment and interest rate that does not change for 15 years. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule.

To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. Pros of a 10-year fix.

Across the United States 88 of home buyers finance their purchases with a mortgage. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. Conventional loans are commonly offered in 15 and 30-year fixed rate loans.

If you take out a 30-year fixed rate mortgage this means. Well also explain when its a good idea to choose this type of loan and when it makes sense to refinance to a shorter term. Regularly switching deals means fees can add up.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. But borrowers can also take 10-year 20-year and 25-year terms. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

This will be the only land payment calculator that you will ever need whether you want to calculate payments for. You might be surprised by how much impact can have. Understanding How 10-Year Fixed Mortgages Work.

The 3-year fixed-rate mortgage is a shorter commitment while the 10-year fixed-rate mortgage offers more stability but comes with a. A 10-year fixed mortgage is a home loan thats paid within a period of 10 years. Must factor in private mortgage insurance PMI in your expenses.

30-Year Fixed Mortgage Principal Loan Amount. However you can get a term length ranging from 1 to 10 years.

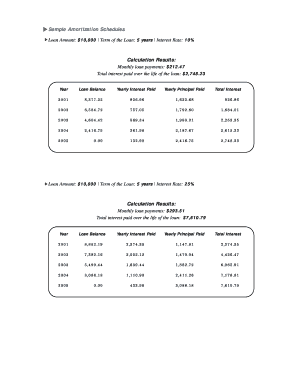

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

2

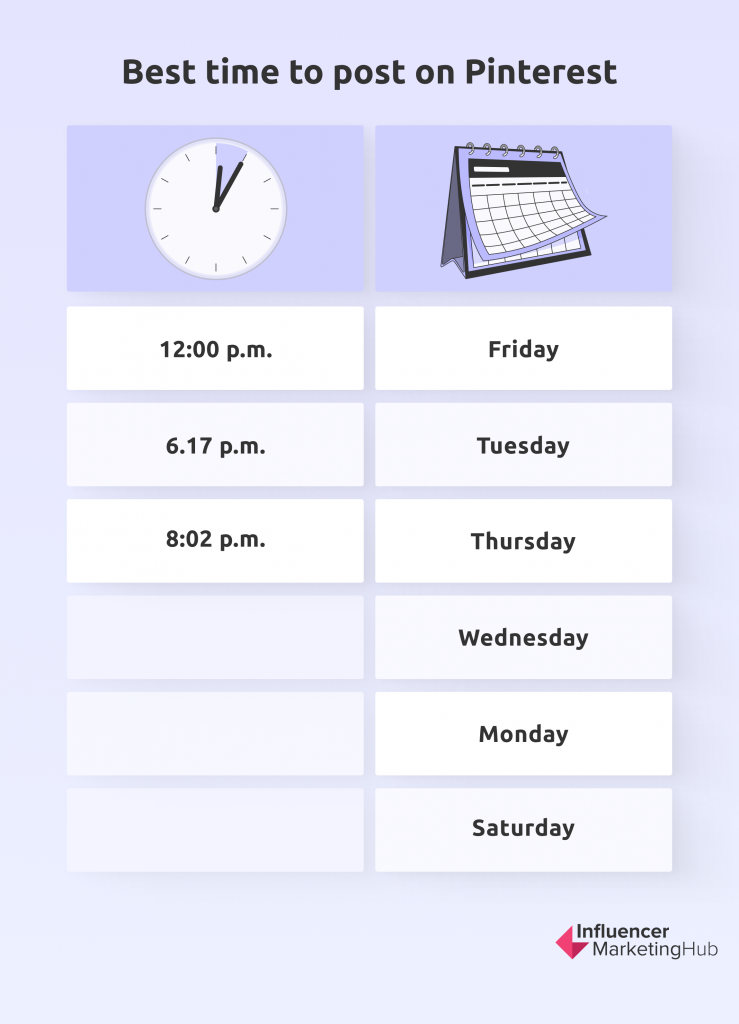

33 Mind Blowing Pinterest Stats For 2022

2

33 Contract Templates Word Docs Pages Free Premium Templates

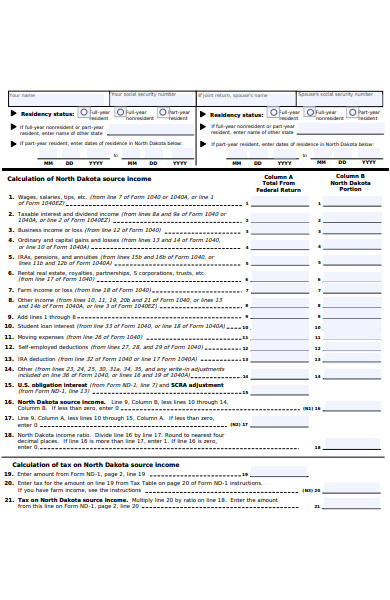

Free 31 Calculation Forms In Pdf Ms Word

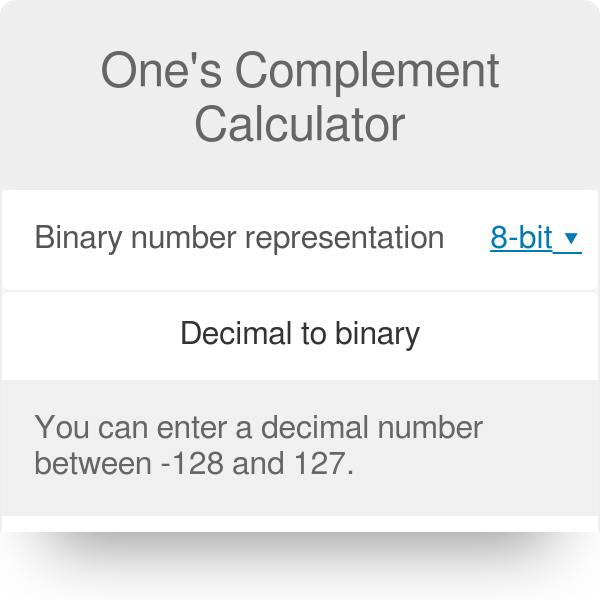

One S Complement Calculator

I Have A Gpa Of 3 88 Unweighted And An Act Score Of 33 Are These Scores Competitive Enough For Georgia Tech And The University Of Michigan Quora

Kenny Idstein Loandepot

2

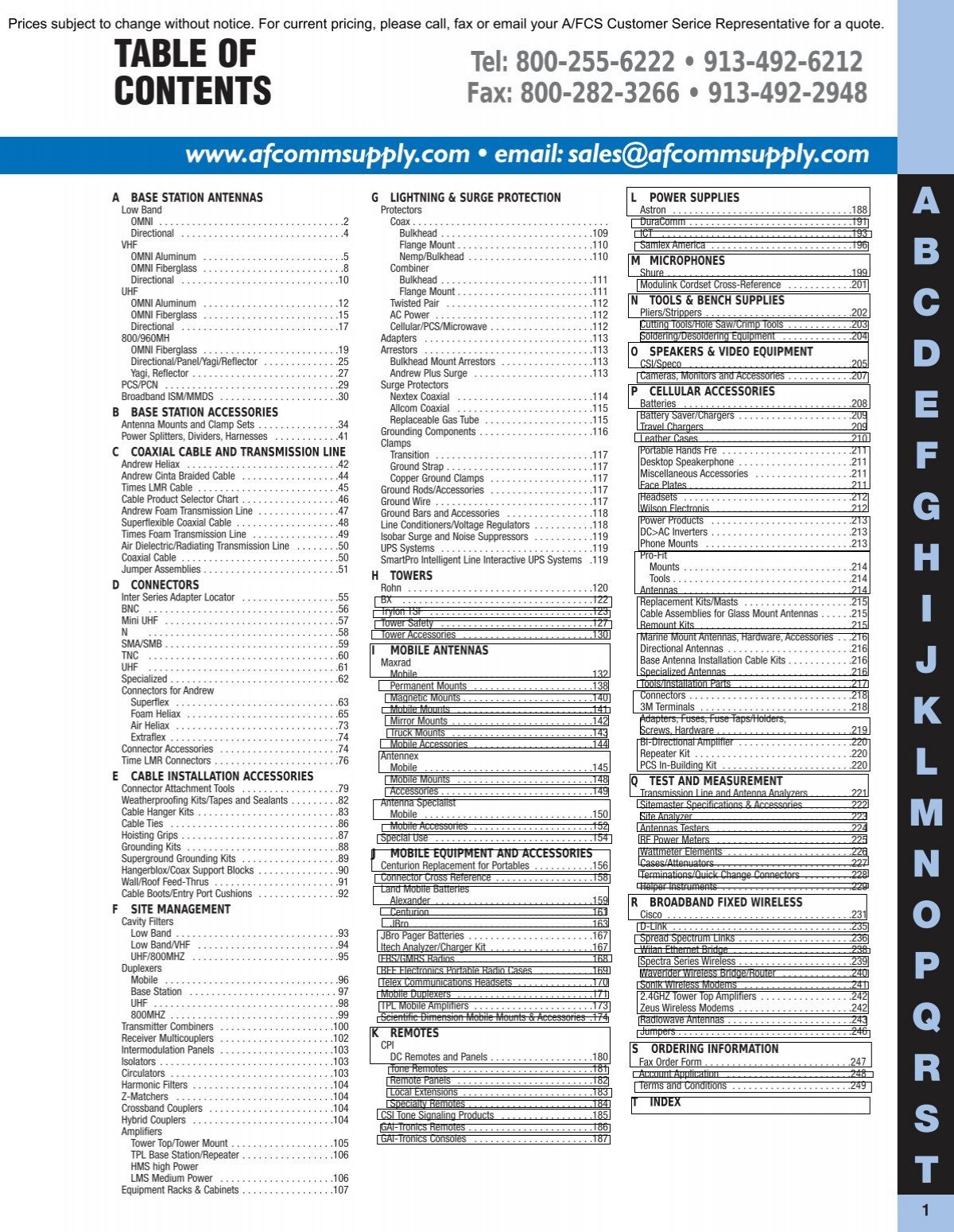

A Base Station 1 33

2

Kenny Idstein Loandepot

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

Pin On Naca Event Locations

Check Out This Behance Project Sign In Login Screens Https Www Behance Net Gallery 50803309 Sign In Login Screens Signs Screen Login

Kenny Idstein Loandepot